If you are looking for a way to predict the future of your stocks, look no further than the APPS stock forecast. In this article, you will learn how to analyze APPS’s PE Ratio. It is important to remember that past performance does not indicate future results. This article will give you the best possible APPS stock forecast for the next 30 days. Also, you will learn how to calculate the PE ratio for APPS, which is an important component to determining a stock’s future price.

Prediction of APPS stock price in the next 30 days

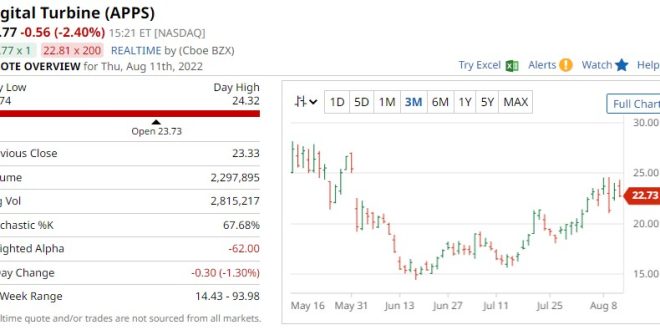

Digital Turbine (APPS) reported an earnings surprise of 8.57% and revenue surprise of 2.14% for the first quarter of 2022. According to Zacks Investment Research, the company had first-quarter revenue of $188.6 million, up 5% year-over-year on an as-reported basis. The stock price was $15 at the end of the first quarter. This growth was expected to continue in the coming years.

Analysis of APPS’s PE Ratio

This PE ratio report analyzes APPS’s price/earnings ratio for 2022. This report includes essential data in tables and charts, as well as a comparison of the company’s current PE ratio to its peers and its market cap. It also shows how APPS’s share price is valued relative to its peers and its forecasted growth. In this report, we will discuss the factors that drive APPS’s PE ratio.

First, let’s define what the PE ratio is. This metric measures a stock’s current price in relation to its estimated earnings for a given period. This is also known as the price to earnings ratio (P/E). APPS’s current PE ratio is 103.85, while its PE ratio for 2022 is 134.33. PE ratio is the most commonly used measure of a company’s earnings.

Another fundamental metric to consider is a company’s price/sales (P/S) ratio. Many investors use the P/E ratio as a measure of a company’s value, but it needs additional context to determine whether it is a good investment or not. For example, the P/E ratio works best when comparing similar companies to determine whether a company is undervalued.

APPS’s PE Ratio

A company’s PE Ratio tells you how much of a company’s profits it has been able to generate in the past year. It is also an indicator of how attractive a stock is relative to its peers. A PE Ratio is calculated by dividing a company’s market cap by its current earnings per share. This measure is often used to determine which stocks are best buys.

APPS’s Momentum Indicator has crossed above the 0 level and entered an Uptrend today. 79 out of 84 positive instances of the indicator have led to the stock rising over the next several days. The stock’s price is expected to fall once it breaks back below the upper Bollinger Band. Alternatively, an APPS stock may decline if it rebounds from above-average levels.

Digital Turbine Inc (APPS) is an undervalued stock relative to its projected earnings growth. The company’s PEG (price to earnings growth) ratio is higher than the market average of 20. This indicates that investors who focus on long-term growth should look at APPS’s valuation. Moreover, the stock’s PEG (price-earnings) ratio is higher than the market average, suggesting that APPS may be undervalued.

The company is currently trading at a price that is attractive for both short-term traders and long-term investors. Its collaboration with other influential giants means that it’s positioned for explosive growth in 2022. As long as it continues to work out well with its partners, Digital Turbine will be unstoppable. If the company continues to develop at the same rate, its PE Ratio in 2022 should be incredibly low.

Apple’s current P/E ratio is 23.3 and its earnings growth rate is 12.6% annualized. Moreover, Apple’s P/E ratio is still high relative to its peers despite its recent outflows. With the PS5 already out of stock, it’s unlikely that Apple’s PE ratio will decrease anytime soon. Its earnings growth rate is still high relative to its peers and analysts believe that Apple’s momentum will continue in the near future.

A higher P/E ratio means you’re paying more for each dollar of earnings. This is bad news from a price to earnings standpoint. Nevertheless, P/E ratios can still be useful for fundamental research, as long as they are compared to companies in the same industry. Moreover, you’ll be better able to identify a stock’s value by its P/E ratio.

Atech Guides Android APPS

Atech Guides Android APPS